Monken Blogger – Lance Marcum

What is a credit score?

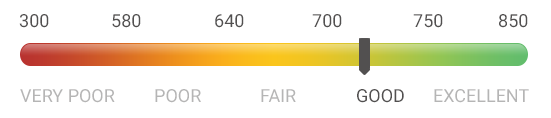

According to Credit Karma, “A good credit score is crucial for financial success. A credit score is a three digit number calculated from your data-rich credit report and is one factor used by lenders to determine your creditworthiness for a mortgage, loan or credit card. Your score can affect whether or not you are approved as well as what interest rate you are charged. A good credit score is generally considered to be 720 or higher. Lenders, however, can each have different standards for what they consider to be a good credit score, so it‘s important to keep building your score to receive the most favorable interest rates and highest rates of credit approval.”

1. What does my credit score need to be to purchase a vehicle?

Generally speaking, if someone has a credit score under a certain level, they will need to have someone who is willing to co-sign with them. It’s difficult to assign a number as there are many variables that go into a credit score. A co-signer is someone that goes on the loan with the buyer. The person with the higher credit score helps the person with the lower score to get approved at a lower interest rate. Sometimes banks will require more money down from a buyer with a lower score in order to minimize the risk of both the buyer and the loan institution. As you can see from the chart above, 600 and above scores will generally get loans without the assistance of a cosigner. Banks also look at what is called “debt to income”. Ideally, they like to see that debt to income is below a certain percentage before approving the loan, regardless of credit score.

2. How do I find out my credit score?

If you have a credit card, they generally offer a free credit report when logging in to your account. Sites such as creditkarma.com also offer free credit reports that do not affect your score by showing up as an inquiry.

3. How can I improve my credit score?

A number of things will help to improve your credit score. Among them are making payments on time and getting rid of any collections that may be on file. In addition, opening a credit card and paying the bill in full each month helps to establish credit (for example, put all of your gas purchases on the card and paying it off at the end of the month). Discipline is the key to all of this. Spend less than you make and pay bills consistently and your credit score will generally improve. It is important to remember that a great credit score isn’t necessarily an indicator of being in good financial standing, it could just mean that a person has lots of borrowed money that they pay consistently on.